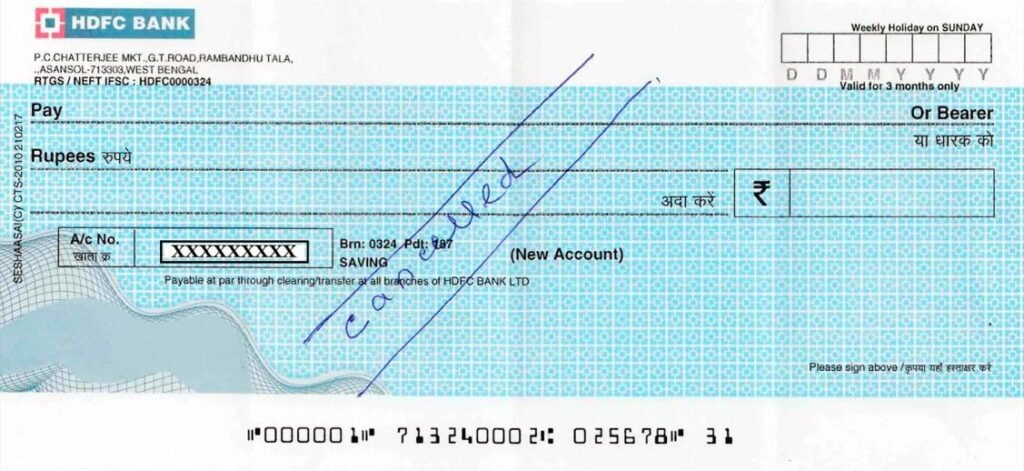

Canceled Check Example we have mentioned below for your reference, A cancelled cheque might seem like a simple piece of paper with a stamp or mark, but it plays an important role in financial verification and recordkeeping. Whether you’re running a business, managing personal finances, or preparing for an audit, canceled checks serve as proof that a payment has been processed and cleared by the bank. These documents are especially useful in resolving disputes, tracking expenses, and confirming transactions.

source: hdfcbank

What Is a cancelled cheque?

A cancelled cheque is a physical or digital copy of a check that has been cleared by the issuing bank. Once the payee deposits or cashes the check and the bank processes the payment, the check is marked as canceled. This mark indicates that the funds have been withdrawn from the issuer’s account and the transaction is complete.

The bank may stamp the word “canceled” across the check or use a digital watermark. Today, many banks provide scanned images of canceled checks on their online platforms, which are just as valid as the original paper checks for proof of payment. Above Canceled Check Example clearly mentioned it is more and more available for varifcation and validation of account details of that particular account holder.

Top 10 Benefits of a Cancelled Cheque, each accompanied by a brief description:

| Cancelled cheque Benefit | Description |

|---|---|

| 1. Bank Account Verification | Serves as proof of account ownership when opening new accounts or applying for financial services. |

| 2. KYC Compliance | Used to verify bank details during Know Your Customer (KYC) processes for investments and financial instruments. |

| 3. Loan Processing | Required by lenders to confirm account details for disbursing loan amounts and setting up EMI deductions. |

| 4. Setting Up ECS Mandates | Facilitates automatic payments like utility bills or loan EMIs through Electronic Clearing Service (ECS). |

| 5. Salary Account Setup | Employers may request it to ensure accurate crediting of salaries to employees’ bank accounts. |

| 6. Insurance Transactions | Needed for setting up premium payments and processing claims in insurance policies. |

| 7. Demat Account Opening | Acts as proof of bank account when opening a Demat account for trading in stocks and securities. |

| 8. EPF Withdrawals | Required to authenticate bank details when withdrawing funds from the Employee Provident Fund (EPF). |

| 9. Refund Processing | Used to verify account details for processing refunds from service providers or financial institutions. |

| 10. Tax Refunds | Assists in verifying bank account information to ensure accurate processing of income tax refunds. |

Why Are canceled check example Important?

cancelled cheque serve as:

- Proof of payment: Essential for resolving disputes or verifying payments.

- Audit and tax records: Useful for both personal and business accounting.

- Legal documentation: May be required in legal proceedings or real estate transactions.

- Internal tracking: Helpful for businesses to monitor outgoing payments.

- Bank reconciliation: Useful when matching checkbooks with bank statements.

How to Obtain a cancelled cheque

Depending on your bank, you may be able to access canceled checks in several ways:

- Online banking portal: Many banks offer downloadable check images.

- Bank statement attachments: Some paper statements include images.

- Customer service request: Call or visit your bank to request a copy.

- Mobile banking app: Many apps now show front and back images of cleared checks.

Some banks may charge a small fee for physical copies, especially if they need to be mailed or retrieved from archives.

What is cancelled cheque leaf?

A cancelled cheque leaf is a cheque that has been rendered void by drawing two parallel lines across it and writing the word “CANCELLED” between them. This process ensures the cheque cannot be used for any financial transactions. Despite being invalid for payments, a cancelled cheque still displays crucial banking information, including the account holder’s name, account number, bank name, branch address, MICR code, and IFSC code. It serves as a verification tool for various financial processes, such as setting up Electronic Clearing Service (ECS) mandates, Know Your Customer (KYC) compliance, loan processing, and opening investment accounts. Importantly, no signature is required on a cancelled cheque, as it is not intended for transactional use.

Common Uses of cancelled cheque

1. Proof of Rent or Mortgage Payment

Landlords or lenders may ask for a canceled check to confirm timely payments.

2. Tax Deductions

Donations or business expenses paid by check may need supporting documents during tax filing.

3. Legal Disputes

Canceled checks provide a timestamp and signature to confirm who paid whom and when.

4. Business Accounting

Companies maintain canceled checks as part of their accounts payable records.

5. Reimbursement Requests

Organizations may require canceled checks to verify out-of-pocket expenses before approving reimbursements.

Can a cancelled cheque Be Used Again?

No. Once a cheque is canceled, it cannot be reused. It has already served its purpose by transferring funds, and banks will reject it if someone attempts to deposit it again. many times some bank also provide and issues special cancelled check book for account holders. Right now no bank accepting cancelled cheque online signature, Institution more and more looking for physical copy of cancelled cheque for these varification purpose.

If a payment needs to be repeated, a new check or digital payment should be issued.

What If You Lose a cancelled cheque?

If you misplace a canceled check:

- Check your bank’s online platform for digital copies.

- Request a duplicate from the bank, though there may be a fee.

- Notify your accountant or payee if the document is critical to a business or legal process.

Are cancelled cheque Safe to Share?

While canceled checks can be used as proof, be cautious about sharing them:

- Sensitive data: They contain account numbers and signatures.

- Use watermarks or cross out details if sharing digitally.

- Send securely: Use encrypted email or secure portals for sending copies.

How Long Should You Keep cancelled cheque?

The length of time you should keep canceled checks depends on your purpose:

- Tax-related checks: Keep for at least 7 years.

- Business checks: Generally retain for 5-7 years.

- Personal checks: Keep for 1-3 years unless needed for legal reasons.

Always check with a tax advisor or financial planner for personalized guidance.

Canceled Check for Bank Verification

Banks often request a canceled check when you:

- Set up direct deposit

- Verify a linked external account

- Apply for a mortgage or loan

In these cases, the check acts as proof of account ownership. It’s often sufficient to provide a voided check (a blank check with “VOID” written across it), but canceled checks may be required if funds have already been exchanged. Many banks when doing Debit card hotlist also ask some canceled cheque for this process for sucessful execution.

Digital Alternatives to Canceled Checks

As banking evolves, there are now alternatives:

- Bank statements showing check numbers and cleared amounts.

- ACH confirmations from automated transactions.

- Wire transfer receipts with tracking and timestamps.

- E-checks with digital clearing verification.

Still, canceled checks remain a reliable standard for many institutions.

Final Thoughts

Understanding the value and use of Canceled Check Example helps protect your financial interests. Whether you’re a business owner tracking payments, a tenant proving rent, or a taxpayer preparing deductions, these documents offer trusted confirmation of cleared transactions. With easy digital access, maintaining and sharing canceled checks is simpler than ever—just remember to handle them securely.

FAQs

What is a canceled check used for?

A canceled check is primarily used as proof that a payment has been made and processed by the bank.

How do I get a copy of a canceled check?

You can retrieve it through your online banking portal, mobile app, or by requesting it directly from your bank.

Is a canceled check the same as a voided check?

No. A canceled check has been processed, while a voided check is rendered unusable before it’s cashed or deposited.

Can I deposit a canceled check again?

No. Canceled checks are marked as already cleared and cannot be reused for any transaction.

Do all banks provide canceled checks?

Most banks offer digital copies of canceled checks, but availability may vary depending on the institution and account type.